The allocation process splits the values from the source data into multiple values and stores them in the target data. Allocations can be used, among others to simulate costs and revenues, make purchasing decisions or set product prices.

The topic of indirect cost allocation is often mentioned in financial statements. This type of allocation is characterized by assigning these costs to various units, processes or products. It can be used in determining the profitability of products or product categories. The SAP Analytics Cloud application allows you to create allocations for planning models in the form of individual stages or entire processes, and then perform structural allocations in the report.

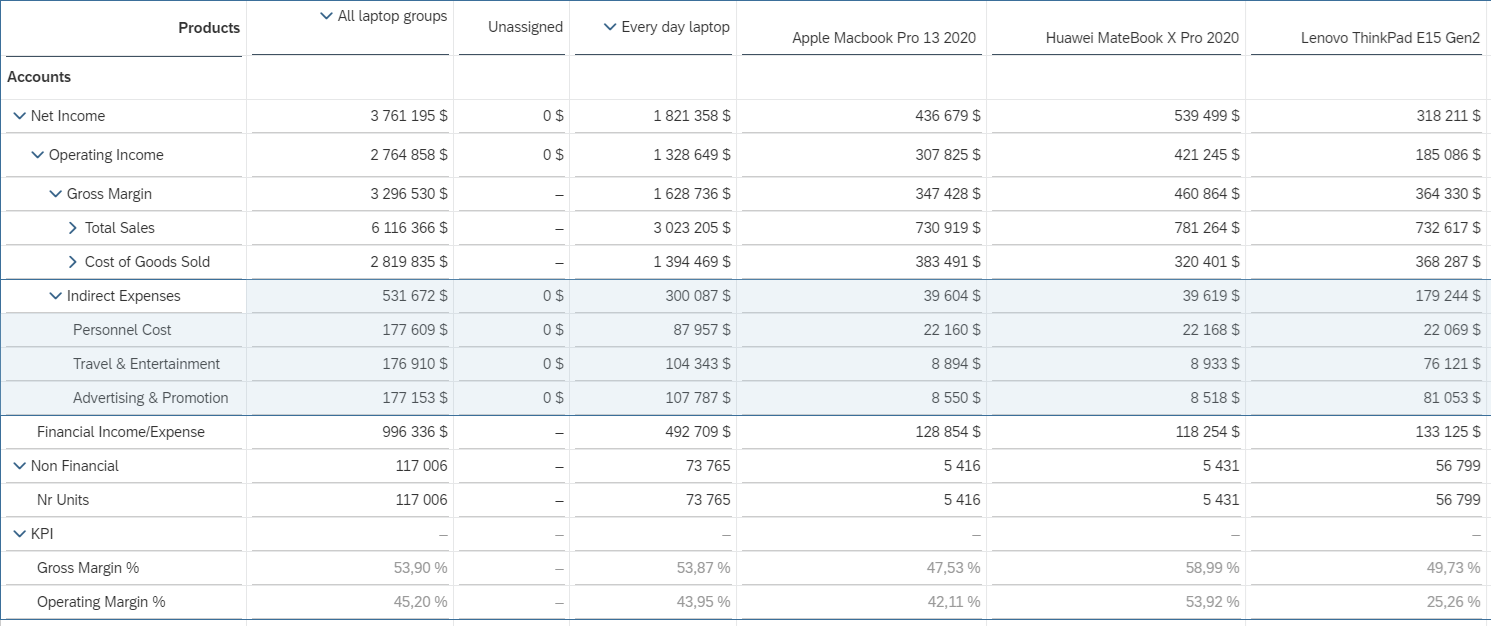

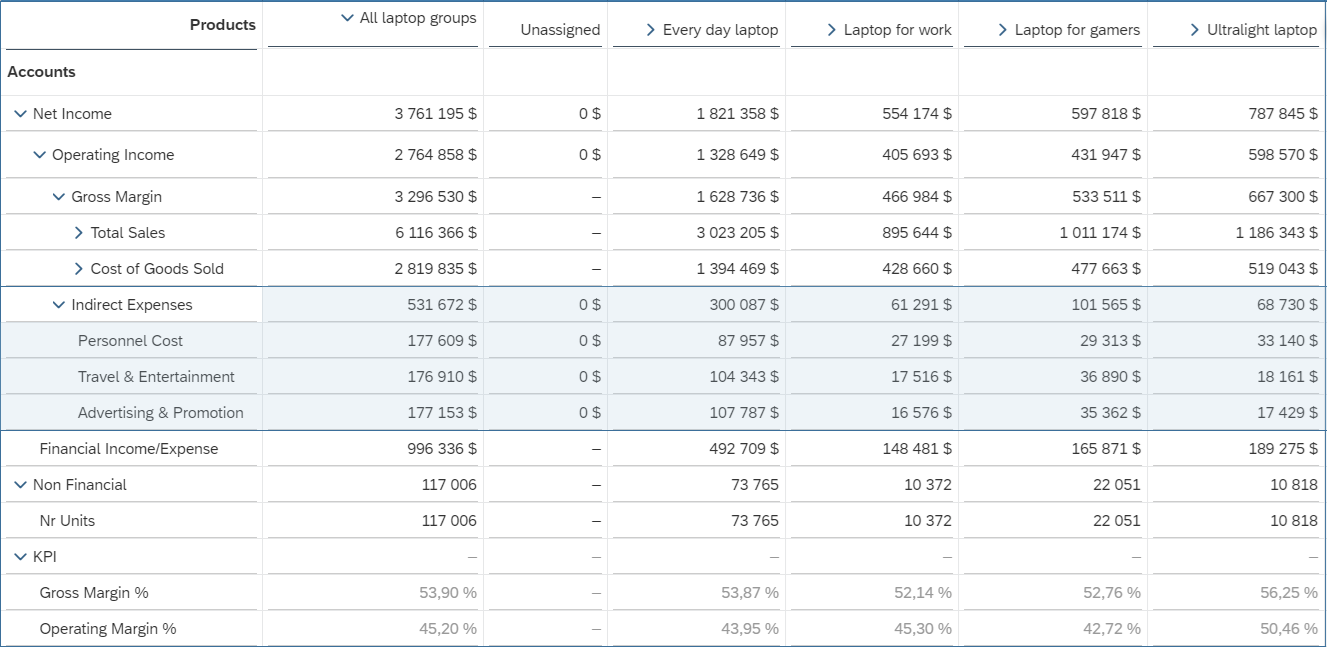

Let's consider a case where the Net Income is obtained from the sale of laptops from different groups. The calculated Operating Margin% indicator shows the profitability of the entire organization, but doesn’t provide insight into the profitability of individual products or groups of products. Indirect costs, such as Personnel Cost, are recorded together for all products (Unassigned column). To determine the profitability of each product and its category, you need to assign cost to levels based on the appropriate driver - In other words, you need to perform the allocation process.

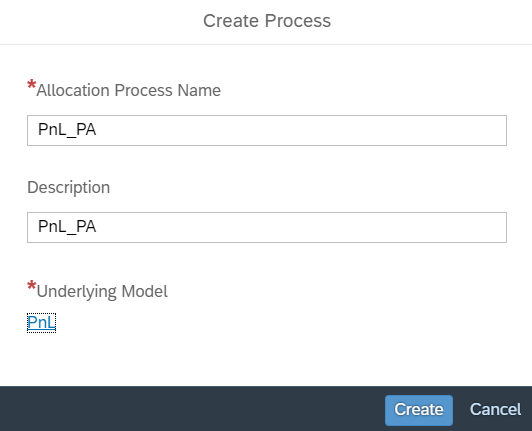

Step 1 - creating the allocation process

The development of the allocation process starts at the SAC home page, via the command: Create -> Process -> Allocation. We enter the name & description and select the base planning model:

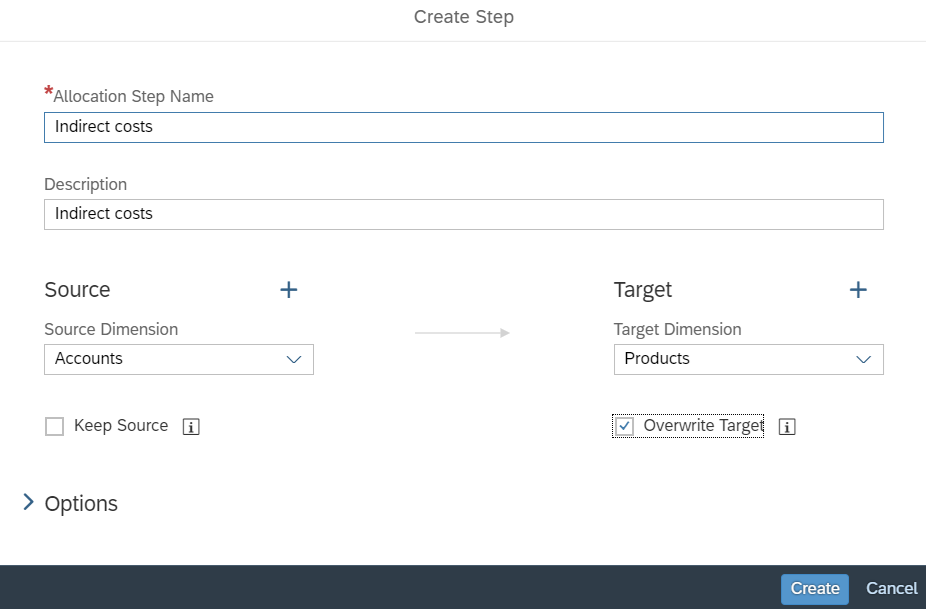

Then we move on to creating a new step:

In the allocation process, values are distributed from the source dimension that contains the value to be allocated to one or more target dimensions that receive part of the distributed value.

In our example, we select Accounts as the source dimension and Products as the target dimension and select the option to override the target value.

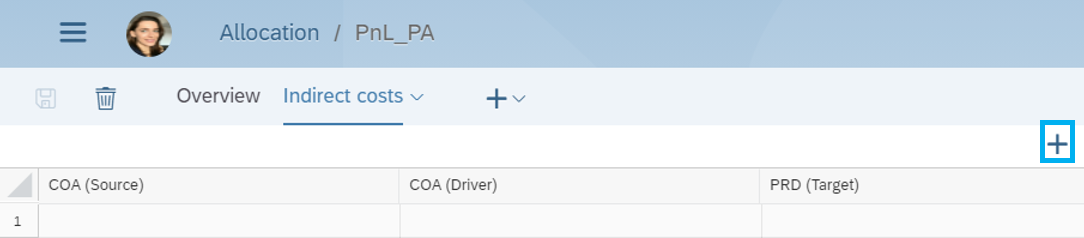

Step 2 - define the allocation rules

Now you need to indicate the appropriate source costs and the driver influencing the change value of products. In the new window, select the first cell and select the + icon, available in the right part of the screen:

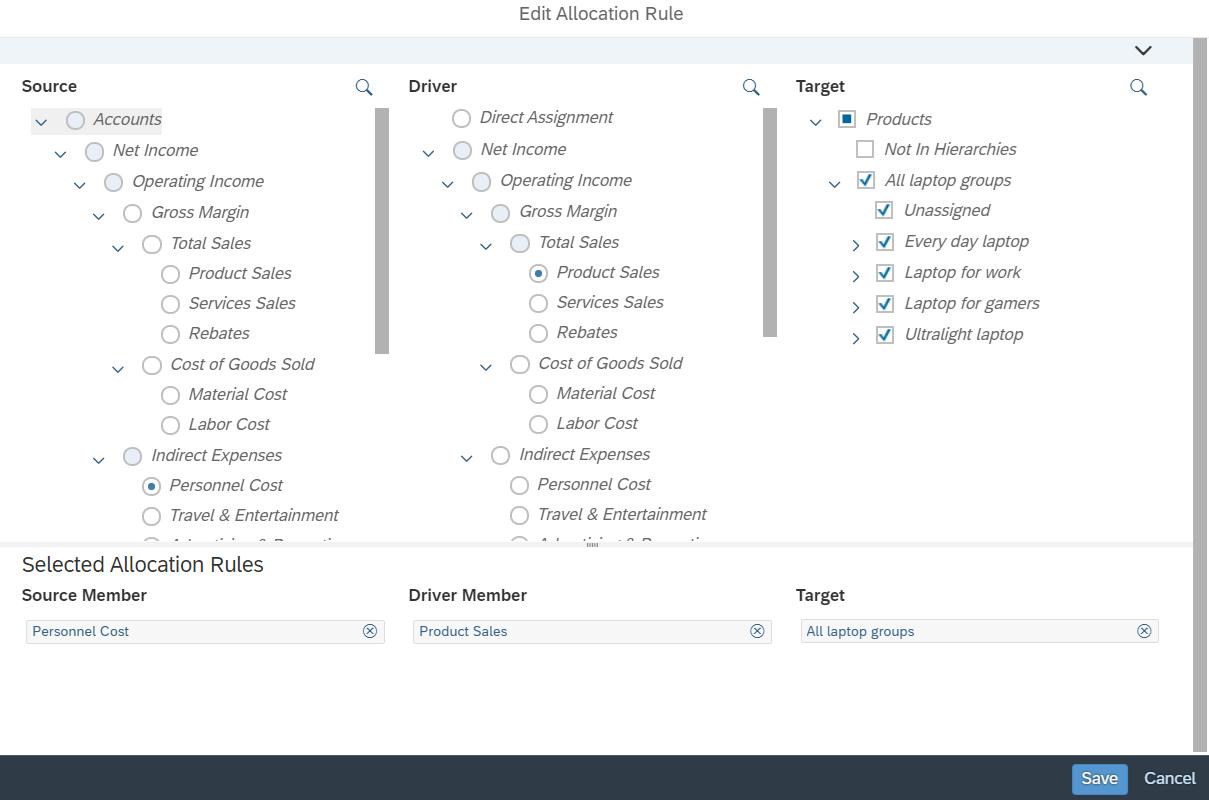

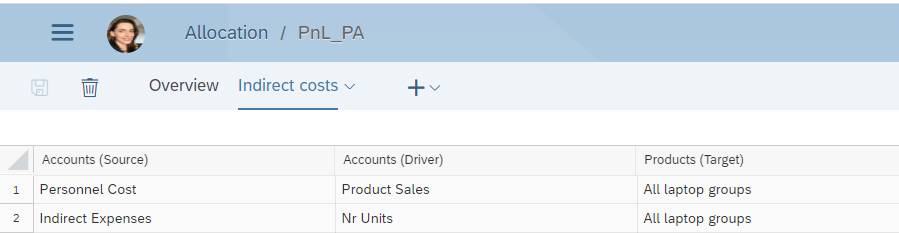

We define the allocation rules by selecting the appropriate items for Source, Driver, Target. We want to distribute Personnel Cost based on Product Sales and assign them to All group of laptops:

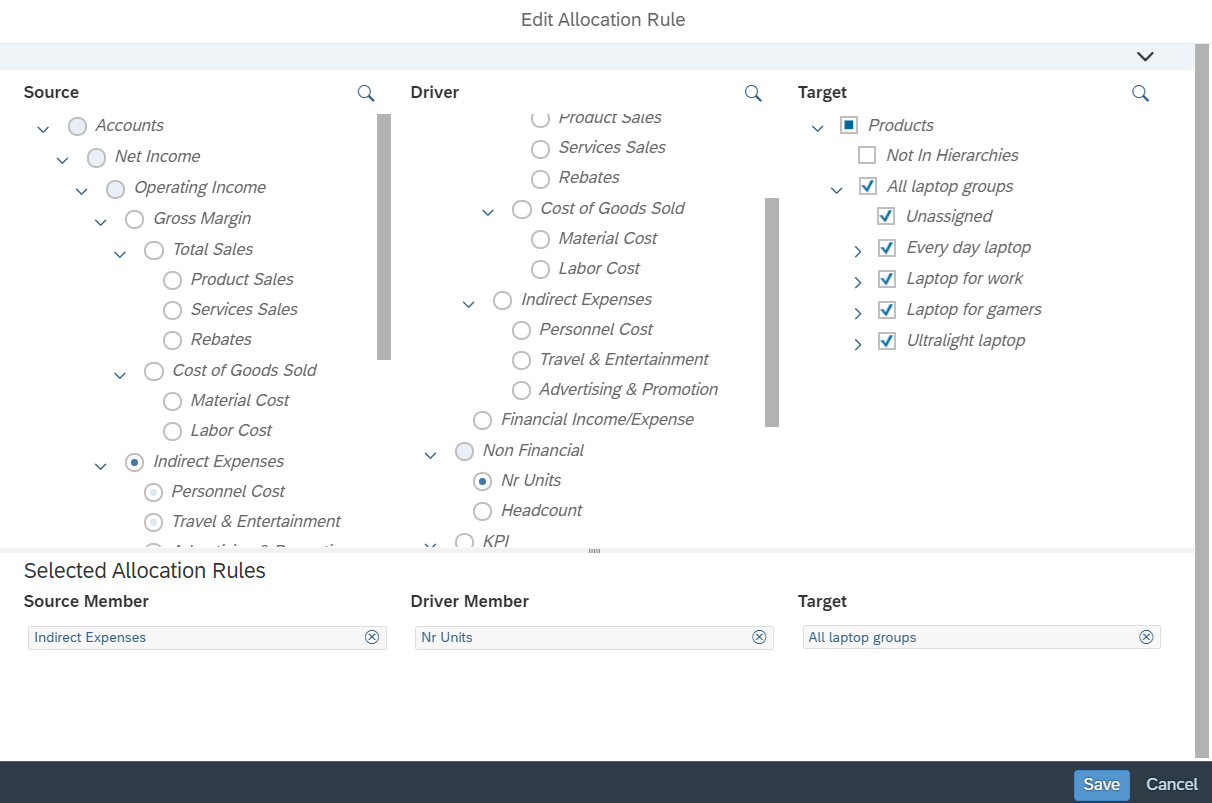

In the next step we add a second rule and distribute Indirect Cost based on Nr Units and assign them to All laptop groups:

Save the entire allocation process using the disc icon.

Step 3 - execution of the allocation process

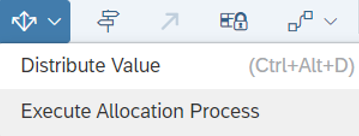

Go to the report and select the option Allocate -> Execute Allocation Process for the base table:

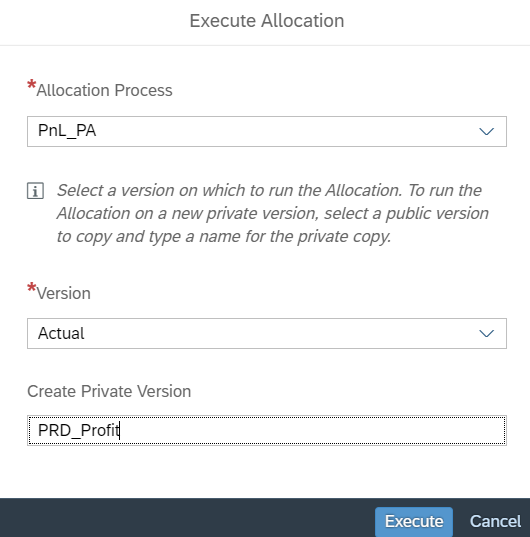

In the window that appears, indicate the previously created allocation process and create a new private version of the data:

Click the Execute button and then Continue.

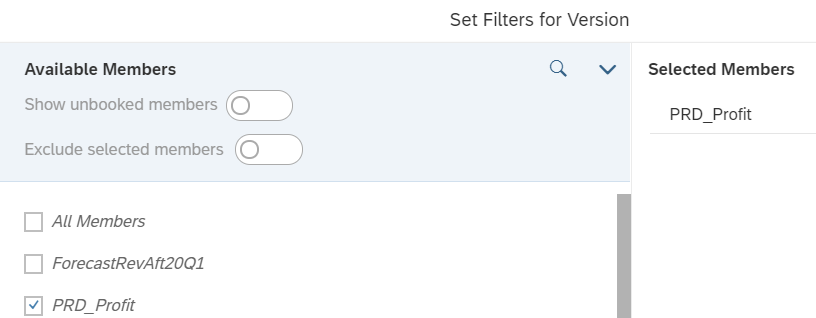

As a result, a new version of the data was created that should be included in the base table by filtering the Version dimension:

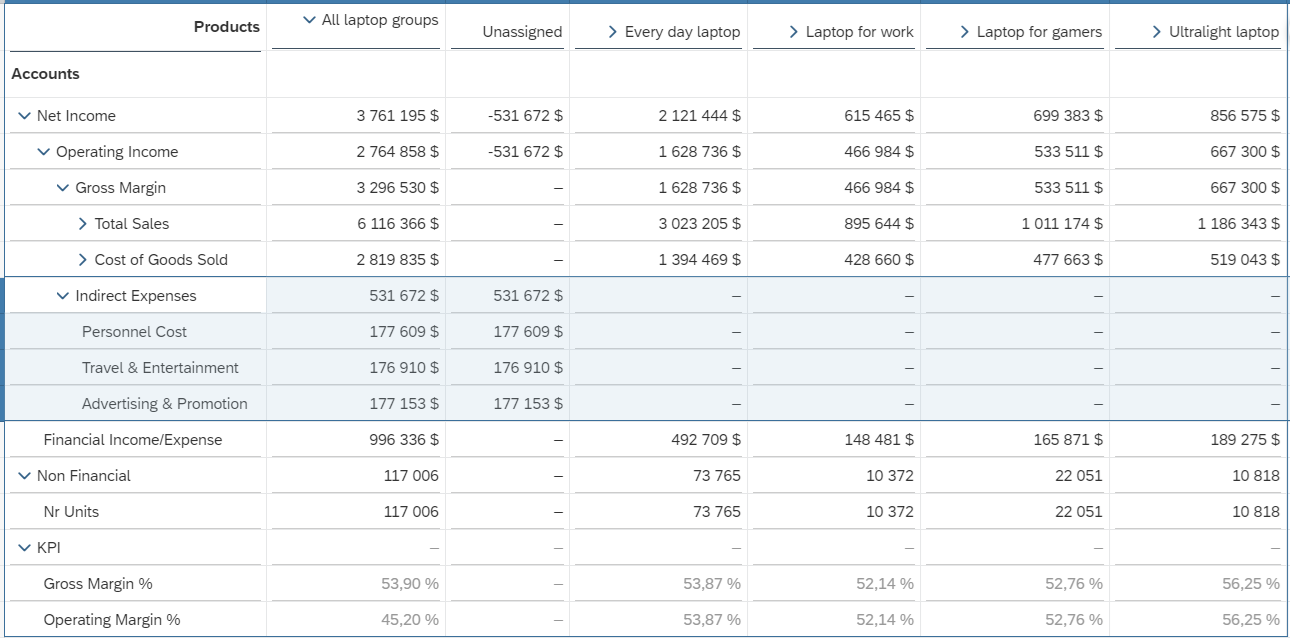

Indirect costs have been assigned to all product groups:

and individual products, which allows you to determine their profitability.